A wraparound mortgage is a financing arrangement where the seller extends a new loan that “wraps around” an existing mortgage. The buyer makes payments to the seller, who, in turn, remains responsible for paying the original lender. This structure requires the original mortgage to be assumable and is formalized through a promissory note outlining repayment terms. Wraparound mortgages are often used in seller financing to bypass traditional lending requirements, offering flexibility for buyers and potential profits for sellers. However, risks include seller default and triggering due-on-sale clauses. Further details will clarify what is a wraparound mortgage and the nuances and implications of this financing method.

Key Takeaways

- A wraparound mortgage involves a new loan that includes an existing mortgage, with the buyer paying the seller who handles the original payments.

- The buyer makes monthly payments covering both the original loan and the seller’s financing, while the seller retains the original mortgage.

- Wraparound mortgages are valid only if the original loan is assumable, ensuring the lender allows the transfer of payments.

- This financing benefits buyers with easier qualification and sellers with potential profit from higher interest rates.

- Risks include default risks and potential conflicts, especially if the original mortgage has a due-on-sale clause.

Definition of a Wraparound Mortgage

A wraparound mortgage is a financing arrangement in which the seller of a property retains their existing mortgage and extends a new loan to the buyer, encompassing the balance of the original loan. This form of seller financing allows the buyer to make payments directly to the seller, who then continues to fulfill their obligations to the original mortgage lender. The seller typically charges the buyer an interest rate higher than that of the original mortgage, enabling them to profit from the difference. The buyer’s payments cover both the original mortgage balance and any additional financing agreed upon in the property transaction.

For a wraparound mortgage to be valid, the original mortgage must be assumable, meaning the buyer can take over the seller’s existing loan terms without requiring the lender’s approval. Assumable mortgages are more common with government-backed loans, such as FHA, USDA, or VA loans. The terms of the wraparound mortgage are formalized in a promissory note, which outlines the buyer’s repayment obligations, including the interest rate and payment schedule. This arrangement can streamline the property transaction process, particularly for buyers who may not qualify for traditional bank financing. However, it requires careful legal documentation to guarantee compliance with the original mortgage terms and to protect the interests of both parties.

What is a Wraparound Mortgage

When a seller opts for a wraparound mortgage, they retain their existing mortgage while extending new financing to the buyer, who then makes payments directly to the seller rather than a traditional lender. In this seller financing arrangement, the buyer makes monthly payments that cover both the original loan and the additional amount financed by the seller. The seller, in turn, remains obligated to pay the existing mortgage, ensuring the original lender receives its due. The buyer’s payments to the seller typically include a fixed interest rate, which may be higher than the rate on the original loan, reflecting the added risk and convenience of the junior mortgage structure.

A secure promissory note formalizes the terms of the wraparound mortgage, outlining payment schedules, interest rates, and other conditions. The buyer assumes the property’s title, but the seller’s existing mortgage remains in place, making the wraparound mortgage subordinate to the original loan. For the shift to occur, the original loan must be assumable, and the buyer must meet the lender’s approval criteria. This process allows the seller to facilitate the sale without fully retiring their mortgage, while the buyer gains access to financing without engaging a traditional lender. The seller’s ability to collect payments from the buyer and maintain responsibility for the original mortgage defines the operational mechanics of a wraparound mortgage.

Benefits of a Wraparound Mortgage

While traditional financing routes may present barriers for some buyers, a wraparound mortgage offers distinct advantages for both parties involved. This form of seller financing can provide a mutually beneficial arrangement, enabling buyers to secure homeownership while allowing sellers to maintain their existing loan and potentially earn additional income. Below are the key benefits of a wraparound mortgage:

- Higher Interest Rate for Sellers: As the seller, you can charge a higher interest rate on the wraparound mortgage than the rate on your existing loan. This payment spread allows you to generate additional profit while continuing to make payments on their mortgage.

- Easier Qualification for Buyers: Buyers often face fewer qualification hurdles compared to traditional loans. This makes homeownership accessible to individuals with poor credit or limited financial history.

- Lower Closing Costs: The streamlined process of a wraparound mortgage typically results in reduced closing costs. Buyers avoid many of the fees associated with conventional lenders, making the transaction more affordable.

- Flexible Financing Options: By offering a wraparound mortgage, you can attract a broader pool of buyers, particularly in competitive markets. This flexibility can expedite the sale of your property.

- Faster Access to Homeownership: The simplified structure of a wraparound mortgage often allows for quicker closings, enabling buyers to achieve homeownership faster than through traditional financing routes.

- Steady Monthly Income: Sellers benefit from a predictable income stream, as monthly payments from the buyer provide consistent cash flow, which is especially advantageous for retirees or those seeking supplemental income.

These benefits highlight why a wraparound mortgage can be an advantageous solution for both buyers and sellers in specific real estate scenarios.

Risks of a Wraparound Mortgage

Although a wraparound mortgage can offer unique advantages, it also carries significant risks that both buyers and sellers must carefully consider. For the buyer, the primary risk lies in the seller’s continued responsibility for the original mortgage. If the seller defaults on the original mortgage, the lender may initiate foreclosure proceedings, jeopardizing the buyer’s equity and possession of the property. Additionally, wraparound mortgages often come with higher interest rates set by the seller, increasing the buyer’s overall borrowing costs compared to traditional financing options. Proper documentation, including promissory notes and deeds of trust, is essential to protect both parties in such arrangements.

For the seller, the risk centers on the buyer’s payment reliability. If the buyer fails to make timely payments, the seller remains liable for the original mortgage payments, which could strain their financial stability and creditworthiness. Moreover, the presence of a due-on-sale clause in the original mortgage could trigger the lender’s right to demand full repayment upon the property’s transfer, creating legal complexities and potential financial penalties.

Both parties must also navigate potential disputes over payment obligations and terms, which could escalate into costly legal battles without clear, enforceable agreements. Below is a summary of key risks:

| Risk | Buyer Impact | Seller Impact |

|---|---|---|

| Foreclosure | Loss of equity and property | Credit damage and financial strain |

| Higher Interest Rates | Increased borrowing costs | N/A |

| Due-on-Sale Clause | Potential legal complications | Demand for full repayment by lender |

| Payment Defaults | N/A | Liability for original mortgage payments |

Understanding these risks is critical to mitigating potential pitfalls in a wraparound mortgage arrangement.

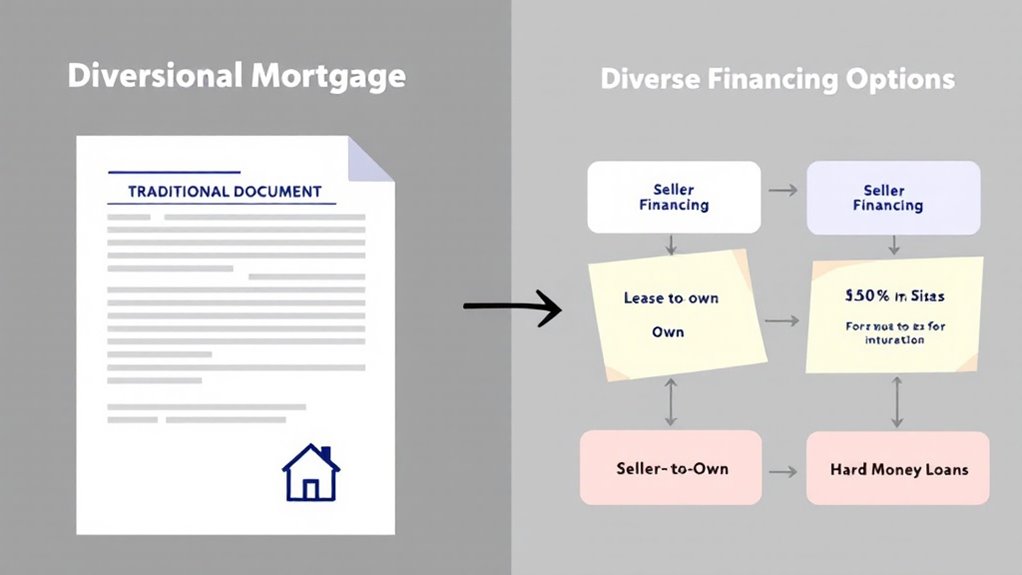

Alternatives to Wraparound Financing

Given the inherent risks associated with wraparound mortgages, buyers and sellers may find it prudent to explore alternative financing options that align with their financial objectives and risk tolerance. While wraparound mortgages combine seller financing with an existing loan, they can complicate mortgage payments and expose both parties to potential disputes with the original lender. Instead, consider the following alternatives:

- Traditional Mortgage: A conventional loan from a bank or lender offers predictable terms and avoids the complexities of a second mortgage. Buyers with strong credit scores often qualify for competitive interest rates and straightforward repayment structures.

- FHA Loans: These government-backed loans provide lower down payments and flexible credit requirements, making them accessible to buyers who may not qualify for conventional loans.

- VA Loans: Available to veterans and active-duty service members, VA loans typically require no down payment and offer favorable terms, reducing the need for seller financing.

- USDA Loans: Targeted at buyers in qualifying rural areas, USDA loans feature no down payment and low interest rates, providing an affordable alternative to wraparound mortgages.

- Seller Financing: If seller financing is preferred, consider structuring it as a standalone agreement rather than a wraparound mortgage. Consult a real estate attorney to ascertain compliance with legal requirements and protect both parties’ interests. Additionally, exploring rent-to-own agreements can provide flexibility for buyers with limited upfront funds while allowing sellers to secure a future sale.

Conclusion

A wraparound mortgage offers creative financing, blending existing debt with new terms, but tread carefully. You’ll assume responsibility for the seller’s loan while collecting payments from the buyer—risks lurk if the seller defaults or terms are unclear. Alternatives like seller financing or lease options may suit better. Before committing, scrutinize the legal intricacies and guarantee compliance. The allure is undeniable, but the stakes are high—proceed with precision and caution.