You’ll find overlooked foreclosure gems in distressed neighborhoods by targeting homes with code violations or absentee owners. Partner with a real estate agent specializing in distressed properties for hidden MLS listings and negotiating power, or work with wholesalers for off-market deals. Join local investment groups to connect with experienced flippers and access valuable leads. Platforms like Foreclosure.com and Auction.com streamline targeted searches, while driving through neighborhoods helps spot neglected properties. Analyzing trends and pre-auction lists guarantees strategic buys—there’s more to uncover for higher returns.

Key Takeaways

- Partner with real estate agents or wholesalers for access to distressed properties and off-market deals.

- Use the MLS and online platforms to filter for distressed properties or “as is” listings.

- Explore auction sites like Auction.com for exclusive fix-and-flip opportunities.

- Network with local real estate investment groups to gain insights and access to undervalued listings.

- Research public records for delinquent mortgages or unpaid taxes to identify distressed properties in your target area.

Get an Agent

One effective way to find houses to flip is by partnering with a real estate agent who specializes in distressed or undervalued properties. Agents have access to the MLS, a thorough database that includes fix-and-flip opportunities, such as foreclosed or neglected homes. When you’re learning how to find fix and flip properties, an experienced agent can guide you through the process, ensuring you target homes with the highest profit potential. They’ll also provide market insights and investment advice, helping you avoid costly mistakes. If you’re wondering how to find houses to flip on Zillow, agents can often identify listings before they’re public, giving you a competitive edge. Look for agents who specialize in REO properties, as they have connections to lenders and institutions offering undervalued homes. By leveraging their expertise, you’ll streamline your search and increase your chances of securing profitable deals. An agent who understands state-specific regulations can ensure your transactions are compliant with local laws, protecting your investments.

Talk to Wholesalers

While partnering with a real estate agent can streamline your search, connecting with wholesalers offers another strategic avenue for finding houses to flip. Wholesalers specialize in identifying distressed properties, placing them under contract, and presenting them to investors like you. If you’re looking for where to find houses to flip, wholesalers can provide access to off-market deals that aren’t publicly listed, saving you time and effort. To maximize your success in finding homes to flip, network within local real estate investment groups to identify reputable wholesalers with strong market insights. However, approach this relationship pragmatically; wholesalers often charge fees and may apply markups to properties, which can impact your budget and profit margins. By carefully evaluating their offerings and ensuring the numbers align with your goals, wholesalers can become a valuable resource in your property acquisition strategy.

Join a Real Estate Investment Group

Joining a local real estate investment group can markedly enhance your ability to identify profitable houses to flip. These groups connect you with experienced investors who share insights on what to look for when trying to flip a house, such as property condition, location, and market trends. You’ll also gain access to strategies for how to find cheap houses to flip, including distressed properties and off-market deals. Here’s how to maximize your participation:

- Attend Meetings and Events: Learn from guest speakers, including successful flippers, who provide practical tips on evaluating properties and negotiating deals.

- Network Strategically: Build relationships that lead to partnerships, joint ventures, and exclusive access to undervalued listings. Networking at these events fosters shared insights and support among industry peers.

- Engage Online: Participate in platforms like BiggerPockets and Facebook groups to access discussions, resources, and listings beyond local markets.

Search the MLS

Searching the Multiple Listing Service (MLS) can open up a wealth of opportunities for finding houses to flip. Partner with a licensed realtor to access this database, as it’s primarily restricted to professionals. The MLS often lists properties that sell faster than For Sale By Owner (FSBO) listings, increasing your chances of securing a profitable deal. Use its advanced filters to identify distressed properties, such as those with high days on market, which may indicate motivated sellers or negotiation potential. Analyze comparable sales to gauge accurate After Repair Values (ARV), ensuring your investment aligns with market trends. Detailed property information, including price history and neighborhood data, allows you to make informed decisions and strategize effectively. Leveraging the MLS streamlines your search, providing a clear, data-driven path to identifying and evaluating potential flips while minimizing guesswork.

Look for Auctions

Observe the given format and style, make no changes to it (e.g., sentence transitions), and ensure the inline link is naturally integrated into the sentence.

Auctions are a strategic way to find houses to flip, often offering foreclosures or bank-owned properties at prices below market value. You can access pre-auction lists to review properties, though physical inspections may be limited, requiring you to rely on research and due diligence. Bidding wars can drive prices up, so establish a strict budget and stick to it. Winning bids typically demand a 10% deposit and settlement within 30 days, often requiring cash due to appraisal issues with financing. Platforms like Auction.com provide exclusive listings and auction calendars to help you plan effectively. Focus on distressed properties found at auctions, as these often come with significant savings and higher return potential.

- Research thoroughly: Analyze property details, location, and potential repair costs since physical inspections may not be possible.

- Set a budget: Determine your maximum bid to avoid overpaying during competitive auctions.

- Prepare funds: Verify you have cash reserves or financing in place to meet deposit and settlement requirements.

Identify Distressed Properties

Distressed properties are a goldmine for house flippers, offering the potential for significant discounts and higher profit margins. Start by targeting REO properties, which are foreclosed homes banks sell at a discount. You can find these on government agency websites like HUD or through lenders’ newsletters. Short sales, where homeowners sell for less than the mortgage owed, are another option. These are often listed by real estate agents specializing in distressed transactions. Public records, such as tax delinquencies and mortgage default notices, can also pinpoint properties in financial distress. Drive through neighborhoods to spot unlisted homes showing signs of neglect, then approach owners directly. Additionally, platforms like REDX provide updated data on preforeclosures and expired listings, giving you a head start on identifying potential flips before they hit the market. Focusing on distressed properties guarantees you’re targeting motivated sellers and undervalued assets. Engaging with local investment groups can also provide access to exclusive off-market deals and valuable insights.

Utilize Online Resources

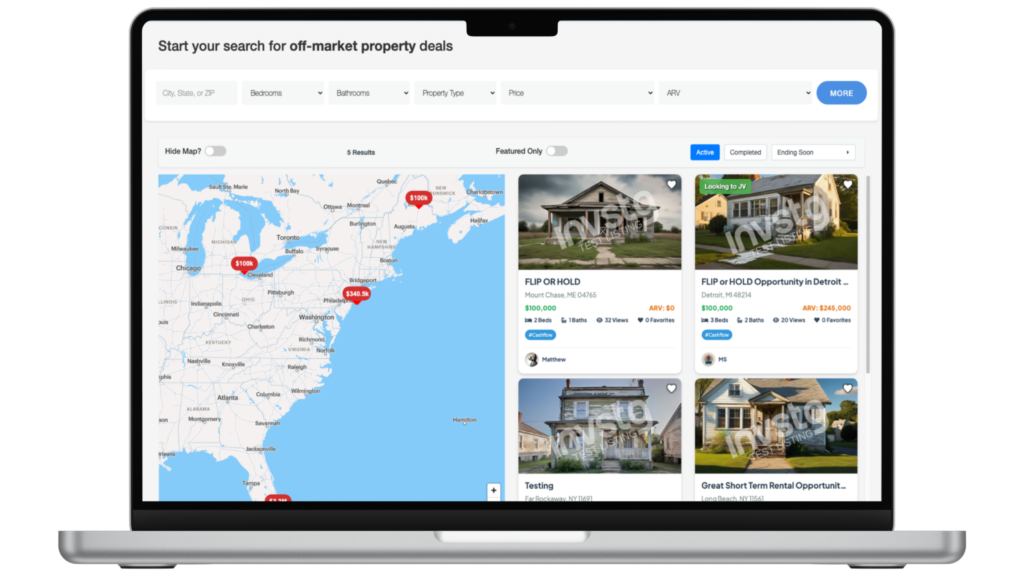

Leverage online listing platforms like Zillow and Realtor.com to filter for distressed properties using targeted keywords. Explore specialized auction sites like Auction.com to secure bank-owned homes at competitive prices. Access distressed property databases such as Foreclosure.com to uncover preforeclosure and foreclosure opportunities. Utilize public records data to identify distressed properties and enhance negotiation strategies.

Leverage online listing platforms like Zillow and Realtor.com to filter for distressed properties using targeted keywords. Explore specialized auction sites like Auction.com to secure bank-owned homes at competitive prices. Access distressed property databases such as Foreclosure.com to uncover preforeclosure and foreclosure opportunities. Utilize public records data to identify distressed properties and enhance negotiation strategies.

Online Listing Platforms

Several online real estate listing platforms, including Zillow, Realtor.com, and Foreclosure.com, let you efficiently search for potential flip properties using filters like “as is” or “fixer upper.” These tools provide access to extensive databases, enabling you to quickly identify undervalued homes. To maximize your search, focus on platforms that allow detailed filtering, such as price range, location, and property condition. Utilize saved searches and alerts to stay updated on new listings. Here’s how to strategically leverage these platforms:

- Filter for Distressed Properties: Use keywords like “foreclosure” or “bank-owned” to target homes with potential for higher returns.

- Monitor Price Drops: Track properties with recent price reductions, as sellers may be motivated to negotiate.

- Expand Your Geographic Scope: Broaden your search area to uncover hidden opportunities in less competitive markets.

Consider exploring off-market properties for unique investment opportunities not listed on traditional platforms.

Auction Site Searches

Expanding beyond traditional online listings, auction sites like Auction.com and Foreclosure.com offer a streamlined way to access foreclosures and bank-owned properties. These platforms provide exclusive listings and auction calendars, enabling you to plan for both in-person and online opportunities. Pre-auction lists allow you to review properties before bidding, though physical inspections may be limited. To avoid overpaying, establish a strict budget and analyze each property’s potential value beforehand. Research historical data, local market trends, and comparable sales to make informed decisions. Be prepared for bidding wars, as competition can drive prices higher than expected. While participating in auctions, use the opportunity to network with other investors, which can lead to additional deals or partnerships. Auction sites remain a strategic resource for uncovering discounted properties ideal for flipping.

Distressed Property Databases

While searching for houses to flip, you’ll find that distressed property databases serve as a powerful tool for identifying high-potential deals. Platforms like Foreclosure.com and RealtyTrac specialize in listing foreclosures and preforeclosures, while Zillow and Realtor.com offer advanced filters to pinpoint “as is” properties. Auction platforms such as Auction.com provide access to bank-owned properties often priced below market value. Public records can uncover hidden gems by highlighting delinquent mortgages or unpaid taxes. Additionally, real estate investment forums like BiggerPockets offer community-driven insights into available distressed properties.

- Specialized Platforms: Use Foreclosure.com or RealtyTrac to access curated lists of distressed properties, saving time and effort.

- Advanced Filters: Leverage Zillow or Realtor.com to narrow down properties needing significant repairs, ideal for flipping.

- Community Insights: Engage with forums like BiggerPockets to gain actionable leads and insider tips.

Conclusion

Partner with professionals to pinpoint prime properties. Tap into trustworthy agents, wholesalers, and real estate groups for guaranteed gains. Scout the MLS, search auctions, and spot distressed dwellings to discover deals. Dig into digital directories for diverse options. By blending boldness with betterment, you’ll build a blueprint for profitable flips. Stay strategic, systematic, and steadfast to secure success in your house-hunting hustle.